whales on whales on whales on TON 🐳

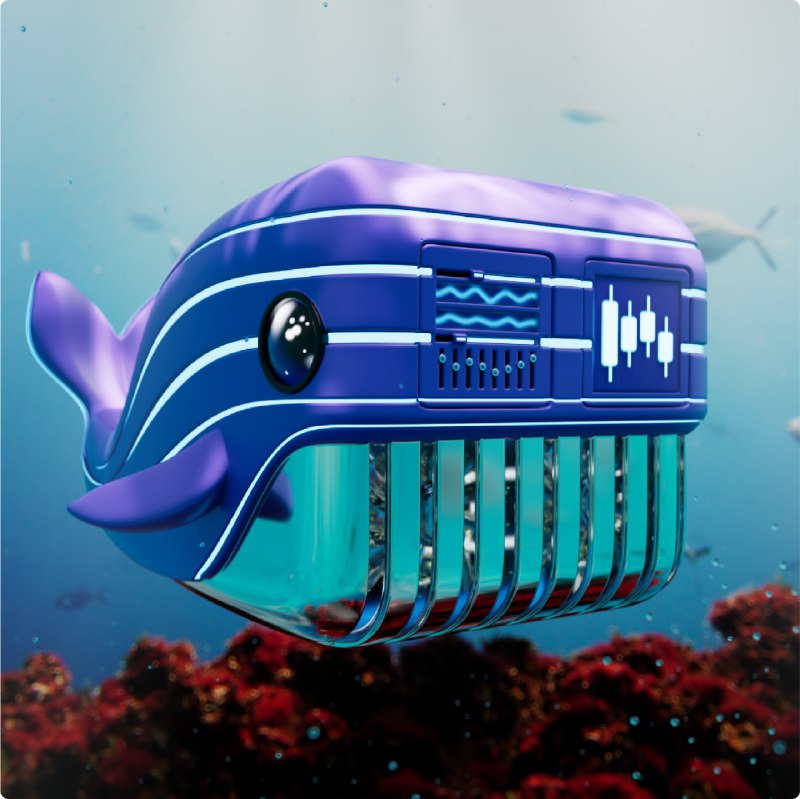

Meet the Miners: The Ton Whales 🐳 💎 ⛏️

Remember when we launched the first-ever virtual crypto miners on the TON blockchain?

— Virtual #Bitcoin Miners backed by IRL data centers, swimming in 35W/TH energy efficiency.

— Up to 64 TH of power, mining ~0.00000123 $BTC (4TH) to 0.00003686 $BTC (64 TH) daily for anyone who holds one 🐳⚡

— Ultra-rare with a sleek TON Blockchain flair. Exclusive and collectible.

Sold out in a splash 🌊 — now, you can only catch them if they pop up on the secondary market.

When Big Fish move, Whales follow 🐳 ⛏️

https://gomining.com/ton/

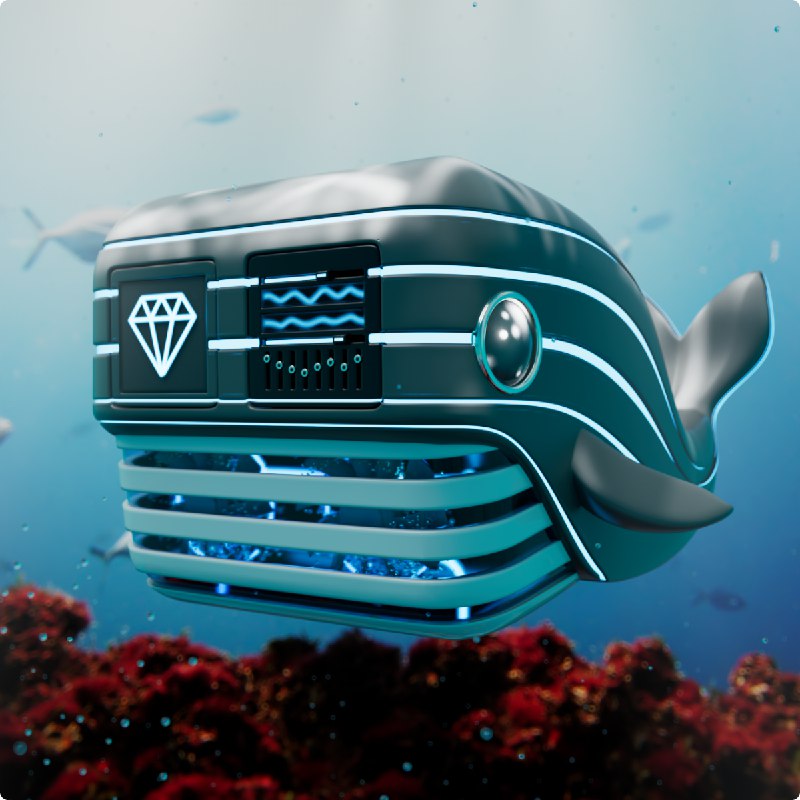

Meet the Miners: The Ton Whales 🐳 💎 ⛏️

Remember when we launched the first-ever virtual crypto miners on the TON blockchain?

— Virtual #Bitcoin Miners backed by IRL data centers, swimming in 35W/TH energy efficiency.

— Up to 64 TH of power, mining ~0.00000123 $BTC (4TH) to 0.00003686 $BTC (64 TH) daily for anyone who holds one 🐳⚡

— Ultra-rare with a sleek TON Blockchain flair. Exclusive and collectible.

Sold out in a splash 🌊 — now, you can only catch them if they pop up on the secondary market.

When Big Fish move, Whales follow 🐳 ⛏️

https://gomining.com/ton/

tg-me.com/gmt_token/3501

Create:

Last Update:

Last Update:

whales on whales on whales on TON 🐳

Meet the Miners: The Ton Whales 🐳 💎 ⛏️

Remember when we launched the first-ever virtual crypto miners on the TON blockchain?

— Virtual #Bitcoin Miners backed by IRL data centers, swimming in 35W/TH energy efficiency.

— Up to 64 TH of power, mining ~0.00000123 $BTC (4TH) to 0.00003686 $BTC (64 TH) daily for anyone who holds one 🐳⚡

— Ultra-rare with a sleek TON Blockchain flair. Exclusive and collectible.

Sold out in a splash 🌊 — now, you can only catch them if they pop up on the secondary market.

When Big Fish move, Whales follow 🐳 ⛏️

https://gomining.com/ton/

Meet the Miners: The Ton Whales 🐳 💎 ⛏️

Remember when we launched the first-ever virtual crypto miners on the TON blockchain?

— Virtual #Bitcoin Miners backed by IRL data centers, swimming in 35W/TH energy efficiency.

— Up to 64 TH of power, mining ~0.00000123 $BTC (4TH) to 0.00003686 $BTC (64 TH) daily for anyone who holds one 🐳⚡

— Ultra-rare with a sleek TON Blockchain flair. Exclusive and collectible.

Sold out in a splash 🌊 — now, you can only catch them if they pop up on the secondary market.

When Big Fish move, Whales follow 🐳 ⛏️

https://gomining.com/ton/

BY GoMining News

Share with your friend now:

tg-me.com/gmt_token/3501